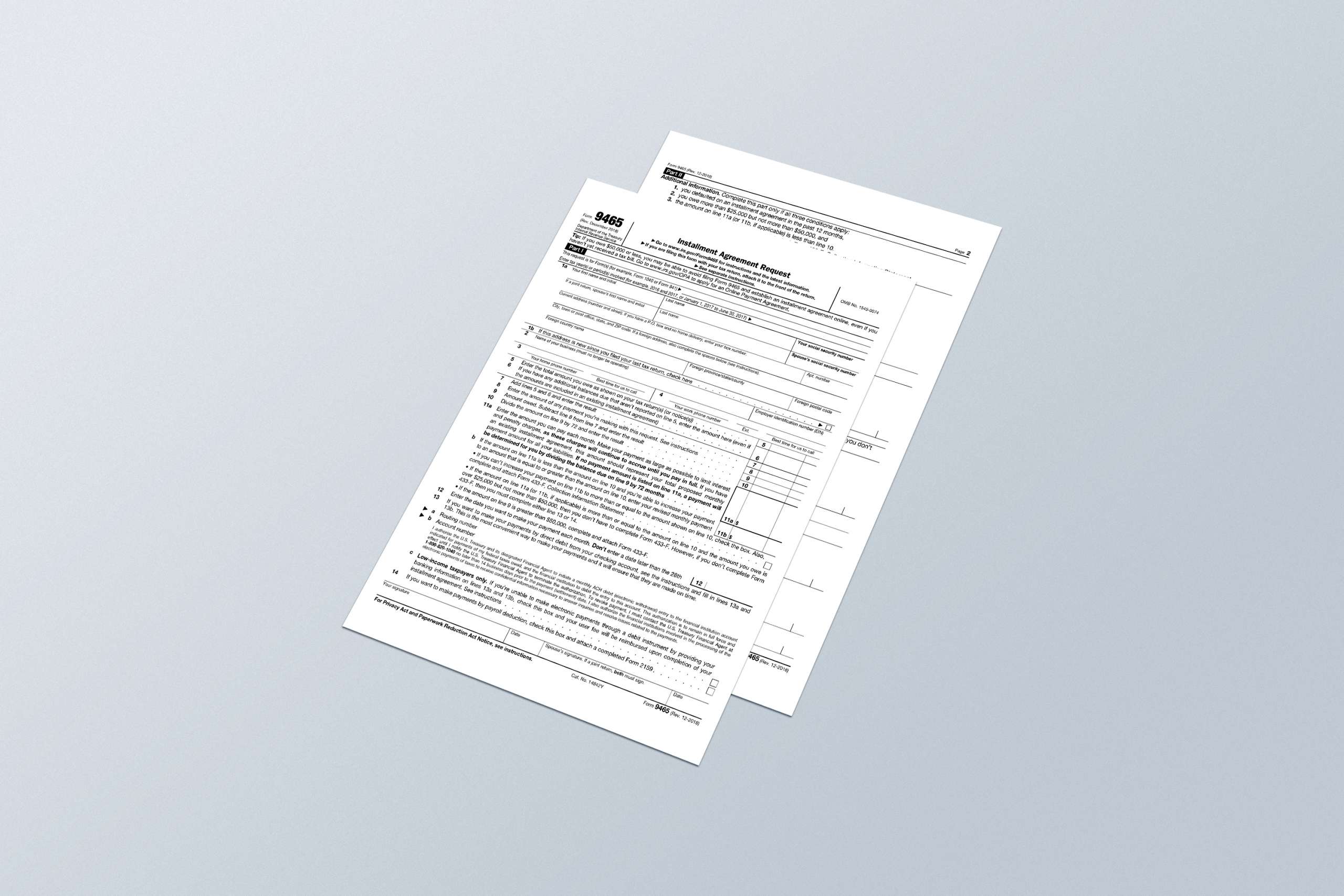

INSTALLMENT AGREEMENTS

If you are not able to pay the Internal Revenue Service immediately or within 120 days, you may qualify to pay the IRS through a monthly installment agreement. It is important that you follow all terms of your installment agreement, including making all payments timely, while remaining current and compliant with all current filings and payments. Penalties and interest will continue to accrue while paying off an installment agreement, so it is still in the best interest of the taxpayer to pay off any amount due in full as soon as possible. If you have questions or need help with an installment agreement, call us at 1-800-408-3122 or email us at taxhelp@iowetaxes.com for a free consultation.

What is an installment agreement?

What if I can’t pay the full amount due even under an installment agreement?

Partial Pay Installment Agreement

Change existing installment agreement

Currently Not Collectible

If a taxpayer can show the IRS that they cannot afford to make any payments now, they may qualify for IRS to place the account in a currently not collectible status.